ECB pumps billions into southern European bonds

This evidenced from the data on reinvestment

Spotlight

-

Έζησα στην Αθήνα της δεκαετίας του 1980 για έναν χρόνο - αυτό μου έμαθε ότι μπορείς να ανήκεις οπουδήποτε

-

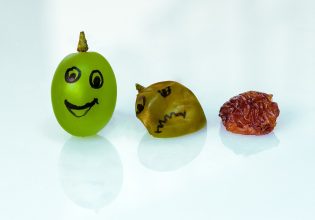

Τα 8 πράγματα που πρέπει να κόψετε για να μην γεράσετε γρήγορα

-

Η σπαρακτική ανάρτηση Καλλιάνου για τον θάνατο του πατέρα του: «Μπανταούλη μου...»

-

Συγκέντρωση διαμαρτυρίας φοιτητών για τα ιδιωτικά πανεπιστήμια έξω από επενδυτική εταιρεία

In an effort to shield over-indebted eurozone countries, including Greece, from the fallout from its decision to tighten monetary policy, the European Central Bank continues to prop up the bonds of said countries. The central bank ended net purchases under the emergency program in March, but is now focusing on reinvesting maturing bonds in the bloc’s most financially fragile members.

According to Financial Times calculations based on central bank data, between June and July, the ECB pumped 17 bn euros into Italian, Spanish and Greek markets, while allowing its German, Dutch and French debt portfolios to shrink by 18bn euros.

Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, said of the ECB’s reinvestment: “The divergence now is very large. It appears that the ECB has been very active in reinvesting almost all of the proceeds from core countries into peripheral countries.”

Intention to support

The reinvestments underline the ECB’s willingness to support countries such as Italy and Greece, and prevent a eurozone debt meltdown as it abandons the loose monetary policy that has underpinned the bloc.

It is recalled that last month the ECB raised interest rates for the first time since 2011, following the decision to end the PEPP program and a long-term bond buying program.

Sven Jari Stehn, chief European economist at Goldman Sachs, said the “range of flexibility used” in reinvesting bond proceeds that were part of the PEPP scheme was “somewhat more than they expected”.

The risk of fragmentation

ECB policymakers and investors worry that tighter monetary policy will widen the gap between the region’s strongest and weakest economies — the so-called risk of fragmentation. Those fears pushed the spread between benchmark Italian and German 10-year bond yields as high as 2.4 percentage points in June, a level last seen during market turmoil in the early days of the pandemic in 2020.

The spread has since narrowed to around 2.1 percentage points after the ECB pledged to take steps to prevent fragmentation. The ECB last month said flexibility in the deployment of PEPP reinvestments would be the “first line of defence” in its bid to contain so-called spreads.

The new tool

The central bank also last month created a new spillover hedge that can be used if PEPP reinvestments fail to keep spreads under control. The tool allows the ECB to buy the bonds of any country it deems to be facing market pressures outside the economic outlook, on an unlimited scale. Investors are watching Italian spreads closely to see when the ECB might step in, with many seeing 2.5 percentage points as an important indicator.

While the ECB has yet to use the new tool, the use of PEPP reinvestments shows how willing policymakers are to keep spreads under control.

Ακολουθήστε το in.gr στο Google News και μάθετε πρώτοι όλες τις ειδήσεις

Αριθμός Πιστοποίησης Μ.Η.Τ.232442

Αριθμός Πιστοποίησης Μ.Η.Τ.232442