Source: tovima.com

Govt Announces Permanent VAT Reductions for Beverages, Taxis

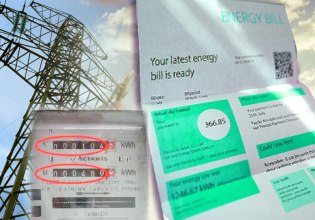

Reduced VAT rate of 13%, from the maximum 24%, aims to support efforts to stem skyrocketing cost-of-living

The finance ministry on Thursday said it will maintain VAT reductions for key sectors, part of ongoing efforts to keep rising cost-of-living down in Greece.

Effective July 1, taxis will benefit from a permanent VAT reduction at 13%, down from the previous 24%, a decision estimated cost state coffers 45 million euros annually.

Concurrently, the reduced VAT rate of 13% will be maintained for coffee, cocoa, tea and similar beverages sold via takeaway and delivery services, with the estimated loss in state revenue of roughly 65 million euros.

By contrast, beverages served on premises will revert to the previous high-end VAT rate of 24%, similar to non-alcoholic drinks and yielding an extra 43 million euros.

Additionally, non-alcoholic beverages intended for delivery (takeaway and delivery services) will continue to benefit from the reduced 13% VAT rate, whereas for those served on-site will return to the 24% rate.

According to the ministry, the decision is part of the conservative government’s “strategic approach” to balancing fiscal prudence with targeted support for affected sectors.

National Economy and Finance Minister Kostis Hatzidakis cited the permanent nature of the VAT reductions and what he called their pivotal role in safeguarding vulnerable social groups and promoting economic stability.

- Ισραήλ: Αποβίβασαν δημοσιογράφο από το αεροσκάφος του Νετανιάχου για «να ελέγξουν τις επαφές του»

- Στα «ΝΕΑ» της Τετάρτης: Ανοίγει παράθυρο σε πυρηνικά όπλα

- Νορβηγία: Το σκάνδαλο Έπσταϊν θα διερευνηθεί από κοινοβουλευτική επιτροπή

- Νέο εργαλείο επιτρέπει να διαγράψετε ανεπιθύμητες φωτογραφίες από το Google Search

- Γουέστ Χαμ – Μάντσεστερ Γιουνάιτεντ 1-1: Γλίτωσαν την ήττα στο 90+6′ οι «κόκκινοι διάβολοι»

- Ποιος θα αντικαταστήσει τον Ερντογάν στην ηγεσία του AKP;